Big? Certainly. But Beauty is in the Eye of the Beholder

Major legislation affecting government spending and the tax code passed Congress and was signed into law over the July 4th weekend. Much of the surrounding news coverage and commentary may lead our clients to wonder if they now face a whole new world and to ask whether it is necessary to overhaul their financial plans and adopt new strategies to avoid tax pitfalls. We want to reassure them that the plans we have built for them will change little, if at all. In fact, now that we know with greater certainty what the tax laws...

read moreNJBEST 529 Plan: Higher Fees, Higher Rewards

KEY TAKEAWAYS The NJBEST 529 plan now offers a state tax break for contributions. Despite higher fees, the NJBEST 529 plan may be a good option for New Jersey residents with moderate to who are looking for a tax break. The higher fees can be avoided if you’re willing to jump through a couple hoops. Intro When saving for higher education expenses, many families turn to 529 college savings plans, for good reasons. Investment growth on contributions can be withdrawn tax free if used for educational expenses, and now, funds not used for...

read moreSecure Act 2.0’s Impact on Your Retirement

KEY TAKEAWAYS Secure Act 2.0 includes over 90 changes to retirement savings plans so at least one, if not more, change will impact you. WJL feels the four changes most impactful to our audience are: increased RMD age, changes to catch-up contributions amounts and types, employers have an option to make matching contributions to Roth accounts, and excess 529 amounts can possibly be rolled into a Roth for the beneficiary. Having a long-term tax forecast prepared will give you the best chance to maximize the new opportunities these changes...

read moreWill the 2023 Tax Bracket Inflation Increases Really Save You Money?

KEY TAKEAWAYS Almost all income thresholds and deduction amounts are increasing by 7% based on Chained CPI for the 2023 filing year. Despite the increase in tax income thresholds due to inflation, you may still owe more taxes over time due to “bracket creep” (possibly as soon as 2023). Preparing a formal tax forecast over several years can help mitigate the impacts of bracket creep. You may have seen the headlines about the 7% increase in the income thresholds for tax brackets in 2023 (for taxes due in April 2024) and how it is...

read moreRetirement with PURPOSE

KEY TAKEAWAYS Even in retirement, purpose is an important part of happiness and fulfillment.Retire into something; retiring with a plan for the future will increase your chances for being happy.Purpose may not only make you happier, it might allow you to retire earlier (compounding the happiness!). Retirement often conjures images of escaping a long-tenured job, possibly one you’ve burned out from, and retiring into a life of leisure and relaxation. You might not realize that the modern notion of retirement is a relatively new creation in...

read moreChoose a Home To Improve Your Quality of Life & Why I Love Moorestown, NJ

KEY TAKEAWAYS The location you choose to live in can impact your life in many ways, improving your quality of life and may result in lower lifetime expenses. Quality of schools, community strength, walkability and commuting distance to work are among the largest impactors. Moorestown, NJ is awesome. Housing is the typical American’s largest expense with transportation (cars) being a close second. Given that, plenty of retirement/FIRE bloggers advise you to move to a lower cost-of-living area, downsize, or even go all out and move into a van...

read morePlanning Actions during a Market Crash

KEY TAKEAWAYS Remain calm and do not panic during periods of market declines and crashes, they are normal part of the investing market and happen frequently. Stay the course and follow your investment policy statement or plan allocations. Actions to NOT do include: panicking, selling or changing positions, and changing investment strategies.Other actions to consider doing: tax loss harvesting and Roth conversions. Okay, first I need to apologize for the click bait-y title. What we are in right now might feel like a crash to a few new...

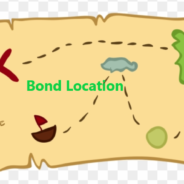

read moreHave $1M More in Retirement with Proper Bond Location

KEY TAKEAWAYS The goal of asset location is to reduce the total tax paid over your lifetime and maximize realized returns.Bond income is taxed at a higher ordinary income tax rate. Stock gains are taxed at more beneficial capital gains tax rates. Because of the two bullets above, investing in bonds inside tax advantaged accounts (pre-tax 401K, IRA, etc) can result in large savings over a normal investment horizon. We are often asked to explain our rationale for keeping bonds in tax-advantaged accounts. This blog post provides an...

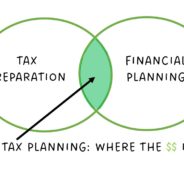

read moreThe Value of Integrating Tax and Financial Planning Services

KEY TAKEAWAYS The goal of tax planning is to reduce total tax paid over your lifetime.Tax preparation done by prepares will only have the goal of reducing taxes in the current year. Very few preparers talk to financial planners. Combining financial planning and tax preparation can enable better decision making across a lifetime of changing tax rates and save tens of thousands of dollars (or more). When WJL Financial Advisors was established, there were two core features we thought added the most value: a flat annual fee for service and tax...

read moreHome Is Where the Heart Is…But Could Home Have Lower Taxes?

Tap into our expertise. Once a month we publish a blog on various financial planning topics. KEY TAKEAWAYS Moving in retirement can result in significant cost savings but the cost to happiness may offset the material gain. Health and your spousal relationship the most impactful items on your happiness. Being close to friends has been found to be more correlated to happiness than material possessions (and being close to grown children!). Sunny weather, a lower cost of living, with lower taxes as the cherry on top. Many people in their last...

read more