KEY TAKEAWAYS

- Secure Act 2.0 includes over 90 changes to retirement savings plans so at least one, if not more, change will impact you.

- WJL feels the four changes most impactful to our audience are: increased RMD age, changes to catch-up contributions amounts and types, employers have an option to make matching contributions to Roth accounts, and excess 529 amounts can possibly be rolled into a Roth for the beneficiary.

- Having a long-term tax forecast prepared will give you the best chance to maximize the new opportunities these changes present for tax savings.

Intro

On December 29, 2022, the SECURE 2.0 Act, one of the largest pieces of retirement legislation seen in recent years, was signed into law. With its 90+ changes to retirement and college savings plans, it will have a dramatic impact on the retirement plans of many Americans and make it easier for individuals to save for their retirement.

Most Americans will be impacted by at least one change, if not more. This post will cover what we consider the most impactful four changes for our clients: increases in the beginning age for Required Minimum Distributions (RMDs), changes to catch-up amounts and types, new employer Roth matching options, and allowing for 529 plan rollovers into a beneficiary Roth IRA.

#1: Changes to the Required Minimum Distribution Ages

The Required Minimum Distribution (RMD) age is the age at which distributions must begin from your pre-tax retirement accounts, such as 401(k)s and IRAs. It is one of the most important factors to consider when planning for retirement.

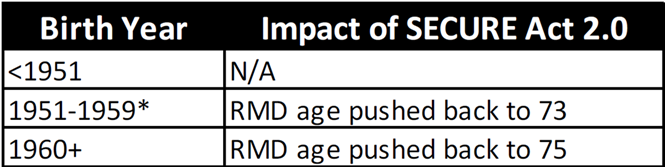

Required Minimum Distributions (RMDs) have existed since the beginning of retirement savings law. Prior to 2019, RMDs had to be taken at age 70½, but the SECURE Act (now referred to as SECURE 1.0) passed in 2019 extended this age to 72.

The SECURE 2.0 Act has pushed back the age to 73 for those turning 73 between 2023 and 2032 and moved the starting age to age 75 for those turning 73 in 2033 and future years. This chart is a little easier to follow:

Action:

Congress increased the Required Minimum Distribution ages for several reasons. One reason, the more optimistic view of Congress, is that Congress recognized that people are living longer and need to save more money for retirement.

The less optimistic view follows the money. Social Security is facing financial difficulties. Congress is looking for ways to shore up the system, and increasing the Required Minimum Distribution ages is one way to do that. By waiting longer to start RMDs, account balances have more time to grow while the withdrawal window becomes shorter. If taxpayers wait until the RMDs kick in, a combination of both effects could push them into higher tax brackets and thus increase tax revenue.

What it does for you, the retiree, is extend the “tax planning window” or time between retirement and when RMDs are required. The tax planning window is a great time to take advantage of tax breaks and strategies that can help reduce your total lifetime tax bill. And that is the goal of tax planning: reduce the amount of taxes you pay over your life, not just the current year.

Here are a few things to consider while in the Tax Planning Window:

- While your income is lower (you are not working and not taking RMDs yet), be sure to take advantage of those tax deductions and credits that apply to you.

- Consider taking distributions from your retirement plan. If you need to take money out of your retirement plan, you may be able to do so without paying taxes if your other income is low enough and you limit the distributions.

- Consider making Roth conversions from your retirement plan. This will allow you to pay the tax on the conversion now, at a lower rate, rather than when you’re required to take RMDs, which could move you to a higher tax bracket.

There is no one-size-fits-all answer to the question of when to take normal distributions or Roth conversions. However, by understanding the tax planning window and your specific situation, you can make an informed decision and potentially reduce your lifetime tax burden.

#2: Changes to Catch-up Contributions

One of SECURE 2.0 Act’s key provisions is the expansion of catch-up contributions beginning in 2024 for some people and limitations on the tax benefits of catch-up contributions for certain high wage earners.

Also starting in 2024, the act increased the catch-up contribution amount for participants turning 60, 61, 62 or 63 in future years to the lower of $10,000 or 150 percent of the current year’s normal catchup amount (150% of 2023 catch-up contribution is $11,250). If participants continue to work past 63, the catch-up amount decreases to the lower amount in those years.

These expanded catch-up contributions could help many Americans who have not been able to save as much as they had hoped due to life events such as job loss or medical expenses during their working years.

SECURE 2.0 also created an income testing on catch-up contributions. For employees earning over $145K from a single employer, any catch-up contributions must be made to a Roth account. Because contributions to a Roth account are made with after-tax dollars, employees do not receive an immediate tax benefit, but all future growth and withdrawals from the account will be free of taxes. The period of this tax-deferred growth could be more limited for employees eligible for catch-up contributions.

Action:

In 2023, high earners should consider maxing out their catch-up contributions if they have not already done so, as this will enable them to claim the full deduction. This is especially important for those who want to retire sooner or may be at risk of running out of money during retirement due to other financial obligations. Additionally, maximizing your catch-up contributions now could help ensure that you can take advantage of any potential tax benefits available in later years when your income is lower and/or when tax laws change.

#3 Employers Can Now Make Matching Contributions to Roth Accounts

The SECURE Act 2.0 includes a provision allowing employers to make matching contributions to their employees’ Roth accounts. This is great news for employees who think they will be in higher tax brackets later and who want to take advantage of their current lower bracket.

The amount of the match will be included in the employees’ income, and taxes will still need to be paid on the contribution amount, but the lower tax rate will be locked in. Future withdrawals, including earnings, will be tax free assuming normal retirement age has been met.

Overall, this is great news for those looking towards retirement planning and wanting additional ways to maximize their savings! Employers’ ability to now offer matches into Roth as part of their benefits packages. should provide added incentive (and motivation) for people to start putting away money early so they can enjoy more financial freedom when they retire!

Action:

If you have done a multiyear tax forecast (or are a client of WJL and have one done every year) and are predicted to be a higher tax rate later, switching to as many Roth options, including this new one, now could be a good tax saving option.

#4 529-to-Roth Conversions

As college tuition costs continue to rise, many parents are turning to 529 plans as a way to save for their children’s education. While it is important to save as much money as possible for your child’s future, potential drawbacks come with overfunding a 529 plan It’s important to understand them before investing too heavily in a 529.

One of the most common concerns is the potential tax on any withdrawal of earnings not used on qualified higher education expenses like tuition and fees.

The SECURE 2.0 Act aims to address this concern by creating the option for a 529-to-Roth IRA rollover beginning in 2024. There are several rules regarding the conversion:

- The Roth IRA receiving the funds must be in the name of the beneficiary of the 529 plan.

- Maximum lifetime transfer is $35,000 per beneficiary.

- (At present it is unclear how a change in beneficiary will be handled.)

- 529 contributions and earnings go into Roth IRA in like-kind.

- The 529 plan must have been maintained for 15 years or longer.

- Any contributions to the 529 plan within the last 5 years (and the earnings on those contributions) are not eligible to be moved to a Roth IRA.

- The conversion is subject to IRA contribution limit, less any “regular” traditional IRA or Roth IRA contributions, annually.

- Roth IRA income limits do NOT apply!

The main purpose of this change is to reduce anxiety about overfunding 529s, but it will also have a secondary benefit of allowing parents to give their children’s retirement plans a jump start.

Currently, the preferred method for most parents to boost their kid’s retirement is to contribute to a Roth IRA once the child has earned income. The 529 rollover option could quickly replace that, because the 529 rollover plan has several advantages. First, funding is not limited by the child’s earned income. Second, the child gains complete control of a Roth IRA when they turn 18, which could be a risk if the child is a spendthrift. By keeping the excess funds in a 529, the parents can protect the assets longer.

Action:

Previously, WJL’s baseline recommendation was to fund a 529 with 2.5 years of expected college expenses, with the remaining amount coming from other sources. However, with the changes in the SECURE 2.0 Act, our targeted amount will be higher if you intend to help fund your child’s retirement. The exact number of years will depend on the cost of your target schools.

Wrap Up

We hope this blog post has given you ideas on how you can utilize the changes in the SECURE 2.0 act to help you save for your retirement and that of your children. Understanding these new options is important to ensure you use all the tax avoidance options available to you, so take the time to consider your options and make sure that you are making the best decisions to support your long-term goals.

Until next time, spend less than you make, invest the difference in low-cost index funds, be kind to your neighbors, and you will succeed in reaching your financial goals and in making the world around you a happier place.

At WJL Financial Advisors, we can put together a personalized financial plan (including help working on a purpose) that will help you reach your goals. If you’re interested in hearing how we can help, give me a call at 215-880-1892 or email me at sean@wjladvisors.com.

The employer still has to actually offer the benefit but it is now allowed. Hopefully more people, especially early in their careers at lower income tax brackets, will utilize this option as it could be huge.

Thank you for the comment and taking the time to read the blog!

Wow! #3 – Employers Can Now Make Matching Contributions to Roth Accounts – seems big. Especially for people who still have a lot of time to save ahead of their retirement.