KEY TAKEAWAYS

- The goal of asset location is to reduce the total tax paid over your lifetime and maximize realized returns.

- Bond income is taxed at a higher ordinary income tax rate.

- Stock gains are taxed at more beneficial capital gains tax rates.

- Because of the two bullets above, investing in bonds inside tax advantaged accounts (pre-tax 401K, IRA, etc) can result in large savings over a normal investment horizon.

We are often asked to explain our rationale for keeping bonds in tax-advantaged accounts. This blog post provides an explanation.

Asset allocation between tax-advantaged (401k, 403B, IRA) and taxable (brokerage) accounts can be confusing because it involves varying expected returns, taxed at different rates, over potentially long timeframes. Yet having a basic understanding of the topic and making the correct allocation could add seven figures (or more!) to the value of your portfolio.

Our Portfolio

The allocation decision comes down to math, and the easiest way to illustrate how the math can work to your advantage is to walk through an example.

Keeping the numbers simple, let’s propose an example portfolio of $1 million consisting of 50% stocks and 50% bonds. The key questions are How should this be allocated between tax-advantaged (401k, 403B, IRA) and taxable (brokerage) accounts? and Does it matter?

Let’s first set out a couple of assumptions about the expected rate of return for each investment and the tax rates.

Expected Rate of Return

Stocks, with their increased risk profiles, have a long-term expected return of 10% in our example. Bonds, with their more moderate risk profile, have a more modest expected return of 5%. This is higher than current rates but not higher than historical rates.

Tax Rates

We need to provide some background on how taxes are paid on the types of accounts we are looking at. Investments inside tax-advantaged accounts (401k, 403B, IRA) grow completely tax deferred for as long as the investments remain in the accounts. But when distributions are taken, whether in retirement, as required to through Required Minimum Distributions (RMDs), or by heirs, the amounts distributed are taxed at the recipient’s ordinary income tax rate. This rate depends on the taxpayer’s income level, but it almost always higher than the preferential tax rates for capital gains.

Inside taxable (brokerage) accounts, taxes are incurred as income is realized. For bonds, each coupon or dividend payment is taxed at ordinary income rates within the year that it is earned. Capital gains on bonds (if you sold them before maturity) are paid at capital gains rates. Tax on stock investments is only paid when the asset is sold, and at the more favorable capital gains rates.

For simplicity, let’s

- assume that all bonds will be held to maturity to avoid capital gains tax and

- ignore stock dividends because these are usually smaller (1–2% of total return) and usually taxed a lower qualified dividend rate.

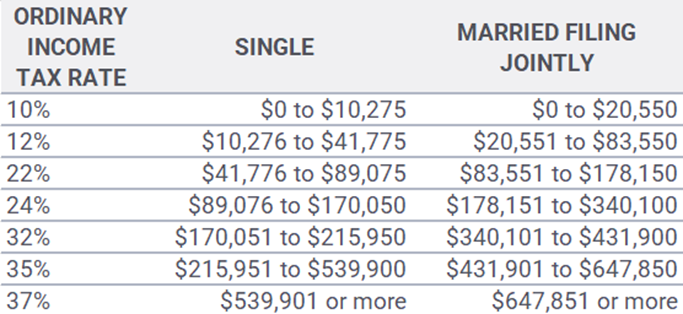

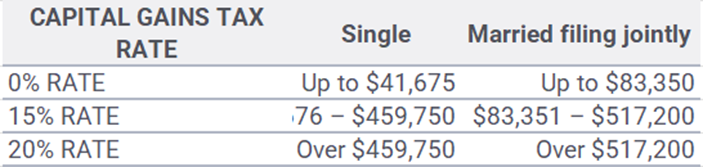

The following tables allow us to compare ordinary and capital gains tax rates for 2022 at each income level.

That’s a lot of numbers! Let’s keep it simple and tax ordinary income (and therefore distributions from tax-advantaged accounts) at 25%. For capital gains, we will assume all investments are held for at least one year and taxed at 15%.

The Portfolio Differences

Calculating taxes incurred inside a tax-advantaged account is easy. The asset grows at the expected rate of return for however many years it is inside the account, and then it’s taxed at the ordinary tax rate when distributions from the account are made.

The taxable (brokerage) account is a little more complicated depending on the investments in the account.

Bonds: Income (dividends) from the bonds is taxed at the ordinary income tax rate as it is earned. Therefore, the 5% return on the investment each year will be lowered by the expected taxes on ordinary income (25%). Our assumption is the bonds will be held to maturity, so no additional capital gains tax will be paid.

Stocks: Since we are ignoring the dividend portion of the investment, taxes on stocks will only be paid when sold. The stock fund will continue to grow at the expected rate of return each year (10%) until sold, at which point the difference between the ending value and initial investment amount will be taxed at the capital gains rate (15%).

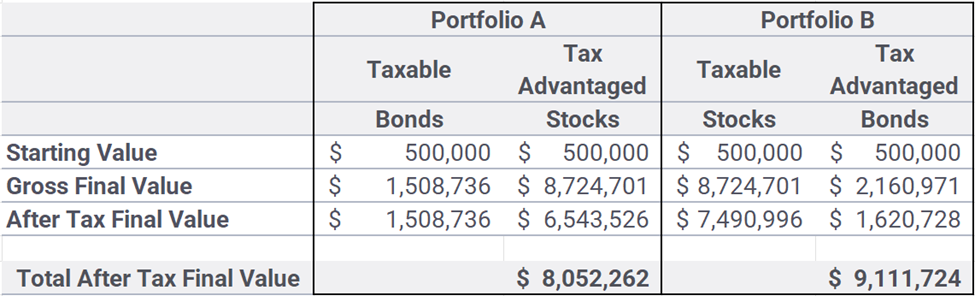

Now we can build two different portfolios, A and B, with opposite allocations. Portfolio A has the entire bond allocation in the taxable account, and Portfolio B has the entire bond allocation in the tax-advantaged account. Over 30 years, here is how the different portfolios would grow.

The Rewards of Having Bonds in a Tax-Advantaged Account

By putting the bonds in the tax-advantaged account, the ending portfolio value is over $1M higher at the end of the 30-year holding period. Shorter holding periods will yield similar, albeit smaller, results.

There are two reasons for the increase in the value of Portfolio B. The first is clear: the lower tax rate on capital gains. The second is less obvious: having slower growing bonds in the tax-deferred account results in less taxes because the account grows more slowly. When distributed, the entire account balance is taxed at the higher ordinary rate regardless of which type of investment is in the account, so having stocks in the account nullifies the benefit of the lower capital gains rate.

Actions by the investor can limit the portfolio gain realized in the example above though. For example, if you decide to actively trade, the portfolio gains on the stocks will be offset by incurring capital gains taxes as trades happen. You will also probably reduce your average returns since the odds of beating the market are against you. This is one of the reasons we recommend passively managed index funds as your main investment vehicles.

If you have any thoughts or opinions about this, please drop me an email or leave a comment below.

Until next time, spend less than you make, invest the difference in low-cost index funds, be kind to your neighbors, and you will succeed in reaching your financial goals and in making the world around you a happier place.