KEY TAKEAWAYS

- The goal of tax planning is to reduce total tax paid over your lifetime.

- Tax preparation done by prepares will only have the goal of reducing taxes in the current year. Very few preparers talk to financial planners.

- Combining financial planning and tax preparation can enable better decision making across a lifetime of changing tax rates and save tens of thousands of dollars (or more).

When WJL Financial Advisors was established, there were two core features we thought added the most value: a flat annual fee for service and tax preparation integrated with the planning. We didn’t, and still don’t, feel a fee based on amount of assets under management (AUM) is fair for most clients. The market naturally goes up, so why should the client pay more each year based on market returns? It’s hard to believe given the rough start to 2022, but in any given year the market is far more likely to go up. Since 1960, the market has increased 79% of the time. The average increase is 11.8% (including the 21% of down years). Therefore, under the AUM model the client is paying an average of 11.8% more per year.

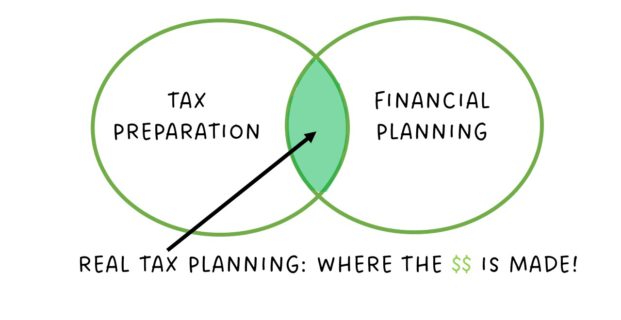

The second core feature we wanted was to prepare the clients tax return. In most cases, financial advisors and CPAs (and other tax preparers) operate in isolation. Neither has visibility to what the other is doing. For the most part, when you give your preparer your tax information, they will crank out an accurate return and do what they can to take acceptable deductions, keeping your tax bill as low as possible based on what you give them. If the CPA specializes in individual tax returns, it becomes a numbers game for them: they crank out the maximum number of tax returns during the limited tax season. You can hardly blame them for trying to spend as little time as possible on each return. Smaller practices may only work during the first four months of the year, while others may spend the rest of the year keeping the books for small business clients, typically a more profitable endeavor.

Tax preparers rarely engage with their individual clients before year end (or ever, outside tax season) to determine strategies to implement in the upcoming year (and beyond) that lower their clients’ long-term tax rate. The goal of tax planning is to lower the total tax paid over your lifetime, not just the current year. Unless the CPA is actively partnering with a client in planning, they will not have visibility to the client’s long-term tax rate projections to know whether it would be better to bring income into the current year or move it to a later year.

As for the typical financial advisors, they tend to focus on the investment portfolio (maximizing gross returns) and don’t always think through tax implications. We have seen several instances, especially in the past few years when the markets have been growing (2019-22), when clients come in with tens of thousands of dollars of capital gains distributions from actively managed mutual funds that could have been avoided if those investments had been in passively managed index funds, which have much lower fees and are better investments even without the tax benefit.

Tax planning can lower the long-term effective tax rate for those who are chasing the FIRE goal (Financial Independence, Retire Early). These individuals may retire early, or semi-retire, and not yet be collecting Social Security or taking required minimum distributions (RMDs). For those not familiar, the IRS requires that distributions from traditional IRAs/401Ks begin at age 72. Those distributions are taxable and, combined with Social Security, can often push someone into a higher tax bracket than they were in during early or partial retirement (for example, if only one spouse is working). This is especially true of moderate earners with high savings rates.

The strategy during these lower earning years is to use Roth conversions to “fill up” the lower tax bracket until a client’s marginal tax rate crosses into the bracket they will be in when taking RMDs. When you do a Roth conversion (which just means moving money from a traditional IRA account to a Roth IRA account), you are taxed on the amount transferred, but once the money is in a Roth IRA it (and any earnings) will not be taxed when later withdrawn. This approach has the added benefit of lowering the amount in the traditional IRA subject to the RMDs later.

Roth conversions are a complicated topic, and you need to make sure you understand them before attempting, but it is a great example of the tax planning tools available when looking at a complete financial picture. Another example is understanding the impact of the alternative minimum tax (AMT), especially in a year with a big bonus or stock option exercise. There are many other tools.

Effective long-term tax planning can make a big difference in the total amount of taxes you pay, which is why WJL provides both tax and financial planning. With tax season here, if you think you could benefit from this type of integrated planning, please reach out to us.

If you have any thoughts or opinions about this, please drop me an email or leave a comment below.

Until next time, spend less than you make, invest the difference in low-cost index funds, be kind to your neighbors, and you will succeed in reaching your financial goals and in making the world around you a happier place.

Thank you for the kind words, we strive to exceed your expectations!

This post points out a terrific observation about combining tax planning with financial planning services. Before working with WJL Financial Advisors I felt there was a disconnect between the two. My accountant gave be high level advice, but based on a short term view. Not so any longer.