During 2018 and into the early part of 2019, volatility has returned to the stock market. Daily swings of 300 to 400 points have not been unusual and are unsettling investors. Is this volatility normal? How are you and your investment portfolio weathering this volatility? What should you be doing to protect your investments? For long-term investors, having a well-diversified portfolio and an historical perspective of the market may provide some comfort.

During 2018 and into the early part of 2019, volatility has returned to the stock market. Daily swings of 300 to 400 points have not been unusual and are unsettling investors. Is this volatility normal? How are you and your investment portfolio weathering this volatility? What should you be doing to protect your investments? For long-term investors, having a well-diversified portfolio and an historical perspective of the market may provide some comfort.

In 2018, volatility returned to the stock market. On February 5, 2018 after an epic two-month rise, the stock market plunged 1,175 points, representing the largest one-day decline in history. In October 2018, the stock market experienced dramatic declines: it fell 832 points on October 10 and 606 points on October 24. As we were all in the midst of celebrating the holiday season, the market dropped 653 points on Christmas Eve, resulting in the worst December market performance since the early 1930’s. In fact, looking back over the entire 2018 year, there were 15 days of more than 2% declines in the Dow Jones Industrial Average. Contrast this with 2017 when there was not one single day of a more than 2% decline.

Is this volatility unusual? Looking back by decade beginning with the 1930’s provides some perspective. You’ll find, for example, that daily increases and decreases of more than 1% during the current decade are actually lower than during the four prior decades dating back to 1970. In fact, one might conclude that market volatility was abnormal in 2017 and returned back to normal in 2018. Economic, geopolitical, and industry instability during 2018 brought uncertainty to the market, and the Federal Reserve continued on its path of raising interest rates. Uncertainty and rising interest rates are two things that the stock market does not like, and the result is more short-term market volatility. Unfortunately, this volatility is likely to continue throughout 2019.

So, what’s an investor to do amidst this increased volatility? First, it’s important to distinguish between volatility and risk relative to the stock market. Volatility is the degree of price changes over a period of time. As seen over the past year, the stock market can be volatile, especially over the short term. Risk as it pertains to an investment in the stock market represents the chance of not achieving your expected return. Over the long term, the stock market has not been risky for those that have held a diversified portfolio. The worst 20-year performance for the S&P 500 going back to 1871 was from 1901 to 1920 when the market was up 4.0%. The average return for the S&P from 1871 to 2018 is 8.9%, assuming the reinvestment of dividends, and there has not been a 20-year period since 1871 during which you would have lost money. Over the latest fifteen-year period, including the market collapse in 2008/2009, the S&P index is up 4.9%.

The reason for the consistent long-term growth in the stock market is that the market is a reflection of the future value of companies that comprise it. When investors invest money in a company, they are providing capital to management to make investments. Successful companies generate a positive return on their investments. A portion of the cash that is generated is then paid back to stockholders in the form of dividends. As a result, the valuation of companies tends to increase over time, which in turn results in an increase in the total valuation of the market. As Warren Buffett often states, he is not sure if markets will be up tomorrow or next week or next month or even next year, but he is sure that in 10 or 20 or 30 years markets will be a lot higher than they are now.

Given the historical backdrop of market returns, investors should evaluate whether they have a properly diversified investment portfolio. Diversification represents the asset allocation between stocks, bonds, and cash. Studies have shown that diversification is responsible for determining over 90% of a portfolio’s return. As an investor, how much of your portfolio is allocated between stocks, bonds, and cash should be based on your risk tolerance and time horizon. An asset allocation that aligns with your risk tolerance means you are not losing sleep during periods of market declines, and your time horizon considers the number of years you have before retirement. As you get closer to retirement, you should have less exposure to stocks and a greater allocation to bonds and cash.

Having a diversified portfolio mitigates the impact of market volatility and reduces the risk of achieving one’s expected investment return. Annual stock market returns over the last 20 years have ranged from a high of 33% in 2013 to -37% in 2008. When bonds, in particular Treasury bonds, are added to a portfolio, they act as a ballast and a stabilizer that reduce volatility since bonds and stocks tend to be negatively correlated. As an example, in 2008 when stocks were down 37%, an intermediate Treasury bond index fund was up 16%.

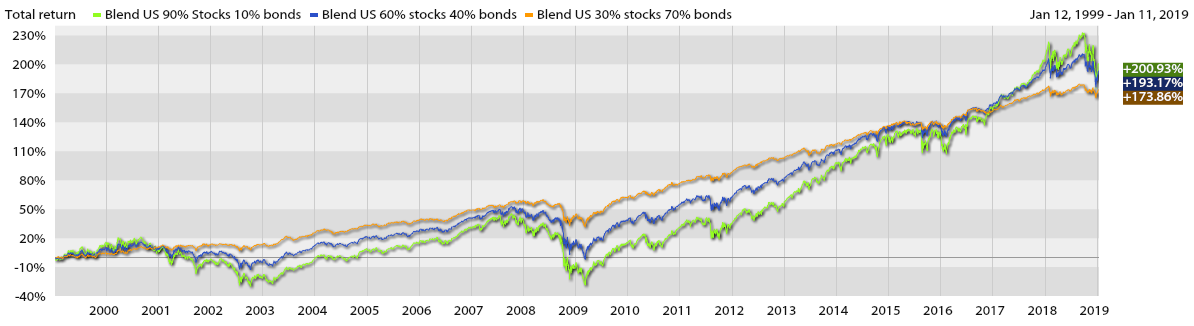

Taking a look at a recent 20-year return for three hypothetical portfolios built using index funds highlights the benefit of diversification. In the chart below, the green line is a portfolio with a 90% allocation to stocks and only 10% to bonds. This portfolio had the most volatility and had a 20-year annualized return of 5.7.%. The blue line is 60% stocks and 40% bonds. This portfolio had an annualized return of 5.5% and noticeably less volatility. The third line is a portfolio allocated 30% to stocks and 70% to bonds. The 20-year annualized return was 5.1% with much smoother returns over the 20-year period compared to the other two portfolios. The largest single year loss for the 30%/70% stock/bond portfolio was 9.2% in 2008 versus 22% for the 60%/40% stock/bond portfolio and 33% for the 90%/10% stock/bond portfolio.

Source: data sourced from Kwanti Portfolio Analytics which licenses data from Morningstar, Xignite, and CSI Data systems.

Given the volatility that has returned to the market, it is important to have a diversified portfolio that aligns with your risk tolerance and matches your investment time horizon. If the recent market volatility is keeping you up at night, it may be time to review your investment portfolio. Given the long-term returns the market has historically provided, it is important to be able to stay the course with your investments during sharp market downturns. Don’t look to time the market, but rather be positioned to invest for the long term.

Feel free to reach out to Bill or myself if you have any questions.