Inflation is a silent killer. It slowly robs investors of their hard-earned wealth through thousands of small latte and burrito price increases. Assets offering inflation protection can help protect investors by providing returns that increase at rates greater than those price increases.

Current inflation measures are heating up. Luckily, investors have inflation protection tools available to them. The most common is stock investing. But there is even a better performing asset in the face of inflation: real estate. In this post we explain how to invest in real estate through either real estate investment trusts (REITs) or direct investment (like on those HGTV property shows you love to watch) and why real estate should be part of every diversified portfolio to provide inflation protection.

KEY TAKEAWAYS:

-

Current measures of inflation are showing the highest increases in the past decade, pushing the demand for inflation protection tools.

-

There are three main inflation protection investments: stocks, Treasury Inflation Protected Securities (TIPS), and real estate.

-

Direct real estate investing provides benefits, including tax breaks, but it requires a big commitment and might not be the right choice for all investors.

-

Publicly traded real estate investment trusts (REITs) can provide most of the benefits of direct real estate investment but with lower capital requirements and increased liquidity.

-

Allocating a portion of your portfolio to publicly traded REITs held in tax-advantaged accounts is the best option for most investors seeking inflation protection.

Prefer video over reading? We’ve got you covered! Watch our YouTube video as we recap this blog post for you:

https://youtu.be/GagVPxcjJ3A

Current Inflation and Inflation Protection Definition

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” – Ronald Reagan

In a prior article, we discussed the threats inflation pose to a long, healthy retirement, namely that the costs of goods and services increase at a faster rate than the return on your investments. That article provides an example of how the price of one consumer staple, a six pack of beer, outpaced the return offered by Treasury bonds due to inflation. Over a long period, such as a normal retirement, inflation is the main threat to your income keeping up with the cost of living.

Given that the most common measures of inflation in the United States are reporting material increases, inflation protection is quickly becoming the most dominant investing topic for long-term investors in 2021. In the past year, the Producer Price index (PPI) jumped 6.6% (May figure, reported June 15) and the Consumer Price Index (CPI) rose 5.0% (May figure, reported June 10). The PPI increase is the largest in the U.S. since tracking began in 2010, and the CPI increase the largest since 2008. If this all sounds abstract for you, let me bring it home. On June 9, Chipotle announced it will be raising prices by 4% across the board. Now those numbers are hitting you right in your burrito-filled bellies people!

Actual Lovison Family Photo

The increase in these metrics have sparked a broader discussion on whether the economy is beginning to overheat. Overheating can occur when the supply of money (demand) increases faster than the economy produces the goods (supply), driving up prices. Money supply can increase due to exceptionally low interest rates or large increases in government spending. Right now, both conditions exist in the economy.

The Federal Reserve’s stance is that the current price increases, such as the price of lumber and bicycles, are temporary shortages caused by disruptions to the global supply chain caused by COVID-19. The Fed’s contention is that once these shortages are worked through, prices will return to their prior levels. Many investors are less certain (you know that burrito price is never going down!) and instead are looking to ensure they have the proper amount of inflation protection in their portfolios. As hopefully they did the entire time…

Background information on inflation metrics:

The Producer Price index (PPI) and the Consumer Price Index (CPI) are the most common measures of inflation in the United States. The data used in both are gathered by the U.S. Bureau of Labor Statistics (BLS) and reported monthly. The PPI measures the average change over time for manufacturers in the U.S. of their reported selling prices. The CPI is a measure of the average change over time in the prices paid by consumers for a select basket of consumer goods and services. There are issues with the methodology of both metrics, but they provide a good indicator of where inflation is going. As they say, these are the best we got.

Assets that Provide Inflation Protection

“I don’t mind going back to daylight saving time. With inflation, the hour will be the only thing I’ve saved all year.” – Victor Borge

Assets providing inflation protection have one main requirement: the returns need to increase along with the rate of inflation. There are three main investments that do this—stocks, Treasury Inflation Protected Securities (TIPS), and real estate.

The stock category is by far the largest group, as it should be. Businesses can, and do, pass along cost increases to their customers. For a good example of this, refer to the Chipotle price increase. Very few of their customers are going to stop going to Chipotle because of the 4% price increase, so Chipotle’s return should remain the same despite inflation.

Treasury Inflation Protected Securities or TIPS is a bond that has its principle amount and coupon payment (the amount you periodically receive) linked to the CPI. Because the return increases with inflation, they do offer inflation protection, but the returns are limited because these are “safe” Federal bonds with low overall rates. TIPS real value is they tend to move separately from stocks which creates diversification. But there is a third, better, option for pure inflation protection: real estate.

There are two major subcategories of real estate available to the average investor:

- Direct Investment (Rental Properties)

- Real Estate Investment Trusts (REITs)

Both offer returns that move with inflation, but each comes with advantages and disadvantages.

Direct Investment in Real Estate

“”Landlords grow rich in their sleep.” ― John Stuart Mill

Direct real estate investing involves buying a property and managing the property for its income production and capital appreciation. More simply put, you buy a house and rent it out. Most individual investors, including myself, usually begin by investing in a single-family residential rental property with a long-term tenant. Airbnb and similar short-term rentals are also rising in popularity outside of the normal beach and mega-ski mountain locations.

Direct investing provides inflation protection since at the end of each rental term the rate charged to the tenant can be increased—and it offers additional benefits:

- Low Correlation to Other Investments: Because the length of a lease is disconnected from current events, returns on real estate do not always move in the same direction as other investments in the short term.

- Lower Volatility: Because direct real estate investments are privately held, they are traded (i.e., sold) less often, and therefore their values do not fluctuate as wildly as stocks or other publicly traded assets.

- Leverage: Direct investment usually involves borrowing funds (a mortgage) to purchase the property. The property acts as collateral for the loan, so you can lock in lower rates. Since you can borrow at low rates and invest the total amount at a better return, it creates leverage that increases your return.

- Forced Equity Growth: A steady rental property is a piggy bank. With mortgage financing, the paydown provides an opportunity to grow equity in the property. This is one of the main reasons long-term real estate investors retire with such large nest eggs—they let the equity build up through the paydown of mortgages.

- Asset Improvement: This should be called the HGTV bullet. Increase curb appeal and increase property value. This is the opportunity to improve the property to enhance performance by finding higher quality or higher paying tenants, reducing vacant rental periods, and updating the appliances, kitchen, or layout. These options give the owner greater control over the return on the asset than other types of investments.

- Income Generation: The income generated through rent can be either passive(ish) or active, but most people investing in property generate a passive income by using a property manager, as I do, to look after the day-to-day running of the property. A property manager can also help ensure you follow local laws or ordinances you may be unfamiliar with if you do not live in the area.

-

Tax Benefits: Direct real estate investing is one of the most tax-advantaged assets in the United States. Between depreciation on the property and pulling out equity gains through refinancing, opportunities exist to pay minimal taxes on direct real estate income. Understanding all the benefits is a vast topic but one of the most important.

Even though I am a great believer in the inflation protection power of direct real estate investment and the ability for it to build multigenerational wealth, there are many downsides:

- Concentrated Risk: Most individual investors who decide to invest in real estate only own one or two properties due to the capital required. This can lead to investing the bulk of your net worth in one or two assets, thus increasing portfolio risk.

- Location Risk: One of the benefits of direct investment in real estate is its low correlation to the broader economy and stock market. Part of the reason for this is that real estate is inherently local. Local politics and economic factors impact neighborhoods and the returns of specific properties. Therefore, the value of your investment may suffer if, for example, a major employer moves out of the area where you own your property even through the rest of the U.S. is in the middle of a boom.

- Cash Flow Variability: Passive cash flow is wonderful, but direct investment can quickly go from generating income to being an expense. For example, a tenant may unexpectedly decide to move out. Repairs may be needed before the search for a new tenant can even begin. A property manager also often takes the first month’s rent as a finder’s fee, adding even more time between a tenant moving out and positive cash flow resuming.

- High Transactions Costs: The costs associated with buying and selling real estate are well known. They include realtor commissions, repairs to get the house in show condition, appraisal costs, and loan closing costs.

- FOMO: “FOMO” stands for Fear of Missing Out. It has been used to describe the social anxiety caused by the belief others might be having fun without you. In investing, this manifests in the fear that others are making money with investments, and you are not. It can create pressure to buy assets at their peak since you just “want to get in on it.” And nowhere is FOMO more powerful than in the housing market. Chip and Joanna sell the real estate dream amazingly well to both primary home buyers and investors (side note, I have been to Waco several times, it’s not great!). I could not find a study linking the number of real estate–focused TV shows to returns on real estate, but the appearance of 15 NEW shows about real estate in 2021 has to be some sort of bubble indicator. It can be hard to keep a level head when assessing a property, and you need to be sure to hold to your property investment requirements. Buying a property just because everyone else is (aka FOMO) can lead to overpaying and poor returns.

The returns for direct real estate investments are hard to aggregate and analyze because each property is as different as the owner. Additionally, the tax benefits realized depend on the tax situation of each investor. Total income, amount of other passive income or ownership of other properties will impact the ability to realize tax benefits.

We at WJL have experience with direct real estate investment and can help you prepare a cash flow forecast for a potential property and help decide if it is the correct investment for your portfolio. But the bulk of the work of direct real estate investment still falls back on the owner. An investor interested in realizing the advantages of direct real estate needs to know there will be a significant amount of work for them to do.

WJL more commonly advises investors to take the simpler approach to real estate investing: REITs.

Real Estate Investment Trusts (REITs)

“Buy land, they aren’t making anymore of it.” – Mark Twain

A real estate investment trust (REIT) is a company that pools capital from many different investors to purchase and, in most cases, operate income-producing real estate. There are REITs specializing in almost every form of real estate you can imagine, including commercial real estate ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels, commercial forests, trailer parks, and single-family residential properties. There are publicly traded REITs as well as privately held REITs. Privately held REITs can be formed by any group of investors to invest in real estate. They are not required to file any information and only report information to their owners. If you are interested in privately held REITs, prepare to get a good lawyer involved as each REIT is individually structured and you will need to be sure you know what you are investing in. However, we focus on publicly traded REITs here, as privately held REITs are too vast and unique to discuss in depth in a single blog.

Publicly traded REITs have a proven track record of providing strong inflation protection. Forbes recently reviewed returns for REITs and found that although stocks have outperformed REITs over the past twenty years when inflation has been slow, REITs outperformed stocks from 1972 to 2020, a longer timeframe that includes the United States’ last period of high inflation. From 1974 to 1981 the Consumer Price Index averaged 9.3%, the most inflationary eight years in its history. Publicly traded REITs’ returns, including income, averaged 16.3% per year during that period compared to 10.1% for the S&P 500. That is good inflation protection.

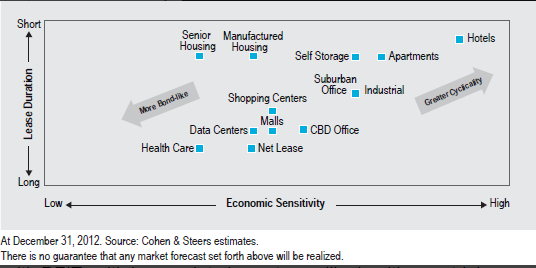

Publicly traded REITs have trading fees similar to those of stocks and mutual funds. Because they are publicly traded, they can generally be acquired and liquidated quickly, but this creates volatility like stocks—although they may not move in the same direction. Each REIT, specific to the type of real estate, comes with its own risk profile and volatility based on the broader economy. This chart shows some of the types of REITs and their volatility based on broader economic health.

Fortunately for investors, much as with stocks, mutual funds have been created that invest in the broader REIT market without having to guess which direction the economy will go. Depending on the fund provider, the mutual fund fee may be higher than a stock fund but still extremely cost effective.

As part of a properly diversified portfolio based on your risk tolerance, a broad-based REIT mutual fund can lower portfolio variability as well as provide inflation protection.

CONCLUSION

“Nature is pleased with simplicity. And nature is no dummy.” – Isaac Newton

Both direct real estate and REIT investing provide strong inflation protection, but for most investors, REITs are the better option. REITs have not only outperformed inflation, they are more liquid, have lower transaction costs, and are less work than than direct real estate alternatives.

There are tax implications with holding REITs, however, and the positions are best held in traditional IRAs or 401Ks. Dividends from REITs are taxed at the higher ordinary income rates and not the more favorable qualified dividend rates of stock dividends.

Until next time, spend less than you make, invest the difference in low-cost index funds, be kind to your neighbors, and you will succeed in reaching your financial goals and in making the world around you a happier place.

If you feel you could use some assistance along the way, please feel free to reach out to us.