WJL Financial Advisors is a firm of finance professionals who left the corporate world, some by choice, some not by choice, but all due to the changing whims of modern Corporate America. These whims, sometimes called “restructurings” or “changes in strategic focus,” are constant no matter how strong the economy or underlying job market. Now they are also being intensified by accelerating outsourcing and job automation. Sadly, these changes will disproportionately impact employees in the later stages of their careers.

Thinking now about other career options, or having a Plan B, can prepare workers for what has become inevitable in modern Corporate America.

Key Takeaways

-

Corporate America is more aggressive than ever pursuing layoffs and restructurings.

-

These mostly affect older, more expensive workers.

-

Think about other employment options while your current position is still strong.

-

You may not want to work in Corporate America forever.

-

If you are an older worker, your financial position may be better than you think.

Prefer video over reading? We’ve got you covered! Watch our YouTube video as we recap this blog post for you:

Threats to Job Security: Outsourcing and AI

One of the questions we ask most of our clients with corporate jobs is What is your plan if your current job is eliminated? The most common response is My job could never be eliminated. That’s a dangerous belief to adhere to when COVID just taught us that quite a few jobs can be done remotely. The next big impact of COVID on the economy may be a massive wave of job offshoring to areas with lower wages/salaries or increased adoption of artificial intelligence to eliminate the jobs entirely.

In my younger, more naïve years, I thought that only underperformers were laid off. But with experience, I realized how wrong I was. Corporate decisions made to boost stock values, appease activist investors, and sometimes just indulge leaders’ whims can lead to entire divisions, departments, or regions being eliminated or offshored through no fault of the workers. Sometimes the corporation may offer you a job, but at a cost too great to absorb, like moving to Cleveland and being forced to become a Browns fan…

Think Ahead

We believe that planning to work in your current role until your early sixties and then retiring completely can be a risky strategy. So we offer ways to mitigate that risk by running alternative scenarios. What if you work in your current role until your fifties and then do something else for ten years that provides less income but schedule flexibility? There are lots of potential iterations, but the goal of these questions is to prompt clients to think about Corporate America’s hiring practices and the risks these practices pose to their financial and life plan.

Keep an Open Mind

If you have been downsized or need to make a move, it is important to keep an open mind as to what your future job might look like. During a job search, most people who have spent the bulk of their career working in a Megacorp instinctively target other Megacorps in their industry. But if you are late in your career, a large company is a difficult place to land a position. Large companies, often concerned with developing future leaders in addition to filling a specific need, can be particularly biased towards younger employees with longer runways.

Smaller companies, in contrast, with less of a hierarchy to worry about filling, may not require elaborate succession planning. They are more likely to focus on finding someone with the skills and experience necessary to fulfill an immediate need. This can be a positive for a seasoned worker with more experience.

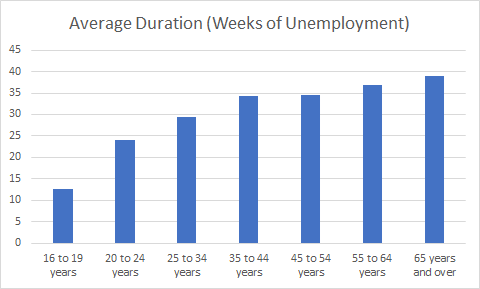

But these companies can also be even more cost conscious than big corporations, which can drive them towards lower salaries and younger workers. CNBC recently did an article that estimated the impact starting as young as 45 years old and this bias towards younger workers can be seen in the U.S. Bureau of Labor Statistics data on the duration of employment benefits by age. The average weeks of unemployment between jobs goes up consistently as age increases:

You may be able to shorten time between jobs by not getting locked into a search for a job as a full-time W2 employee and being flexible to different employment agreements. In many cases, a company’s need (particularly that of a small company) may not be long term, and hiring a contractor or consultant might make the most sense for them. For the job seeker, flexibility is key.

Don’t let your fear of losing health care be a limiting belief either, right now is the best time in recent history to get healthcare through a state healthcare exchange.

Take the time to consider career alternatives whether you are currently employed or in transition. I realize that for many, thinking through this is daunting, and it is easy to procrastinate on this kind of planning. But as those who have taken the time to put together a plan would attest, it is an exercise that is well worth it.

What Is Your Plan B?

You never know what the future will bring. Even if you enjoy what you are doing and consider your role to be secure, it still makes sense to think about a Plan B. The young kids (or Millennials) call this a “side hustle.” It may or not make you much money, but it can develop a skill or nurture a business you can move to in the future.

Determining your Plan B is, of course, the hard part. Even though I always saw myself going into the financial planning field, it was not my only Plan B. I taught night accounting courses at a local college (shout out to Collin College!) for a couple years to give teaching a shot. The process of finding your dream job is does not have to be a straight line. Don’t be afraid to try new things and—now this is the hardest part—stop doing them if you aren’t enjoying them. Even if you’re good at them. If you don’t, you could end up years later in the same position you’re in now.

The Rest of My Story

My last corporate job was not eliminated, but I spent the last couple of years helping build low cost “shared services centers” outside of the US and then moving jobs from higher cost areas, namely Canada and the United States, to the new centers. In my younger years I may not have had a problem with participating in this process, but with perspective of experience I did.

My undergraduate degrees were in Finance as well as Economics, so while I understand and appreciate division of labor and “creative destruction,” it was hard looking across the table at employees you’ve worked with for decades and letting them go. Fortunately for me, forced into becoming the maker of creative destruction was enough of a push to get me out of the corporate world and create a new path for myself.

I have always had a great passion for helping people reach their financial goals, and being a financial planner was my long-term goal. I can easily see myself doing this for another 20 to 25 years. For all these reasons, and the fact that I get to determine when to stop working (or dial it back), I consider it a less risky plan in the long run than remaining in the corporate world, even with the up-front risk of striking out in a new direction.

You Probably Are Better Off Than You Think

If you are working full time and raising a family, you may find it difficult to take the time to step back and reflect on alternative career options. Even people who end up in transition find this kind of reflection difficult. In many cases, after losing a job, people immediately dive into the job search without taking the time to assess what really makes sense as a next step. Some people, of course, are in dire financial situations and have no choice but to take any job they’re offered. But when we sit down with clients and crunch the numbers (especially with more established clients, who are most affected by layoffs), many clients going through a transition discover that they are in better financial shape than they thought they were.

This past year, and for the remainder of 2021, workers are enjoying some of the most generous social benefits in US history. Most workers with years of experience (and savings) don’t need to find a corporate job similar in compensation, or demands, to the one they just left. Most still want to work since they are not yet ready for full retirement, but looking for a job because you want to work and have the luxury to consider alternatives is very different from searching for a job because you need to work for financial reasons alone.

Until next time, spend less than you make, invest the difference in low-cost index funds, be kind to your neighbors, and you will succeed in reaching your financial goals and in making the world around you a happier place.

If you feel you could use some assistance along the way, please feel free to reach out to us.