Tap into our expertise. Once a month we publish a blog on various financial planning topics.

KEY TAKEAWAYS:

- The availability of new cars due to supply issues is at a record low while demand is high due to increased discretionary funds, creating record high new car prices.

- Federal and state (especially in New Jersey) tax credits related to electric vehicle adoption significantly change the total cost equation.

- Tax credits may become more limited for high earners in the future due to political pressure created by most of the current credits benefiting upper income taxpayers.

- Despite the market conditions, now may be a good time to purchase an electric vehicle if you are in the market for a vehicle and are an upper income taxpayer.

Prefer video over reading? We’ve got you covered! Watch our YouTube video as we recap this blog post for you:

The Red-Hot Auto Market

Auto news headlines are reporting how red hot the car market is right now. The average price for a new car just crossed over $40,000 for the first time in December 2020. It was hoped this was a short term spike caused by COVID related supply chain issues, sadly, prices have actually increased to $40,206 as of June 2021.

Side note: Of the $40K new car purchase price, an average of $35K was borrowed, with the most common term being 72 months. The second most common length was 84. Please for the love of your finances, don’t do this! This is a sure recipe to be upside down on your car for a very long time. If you need to consider financing over 60 months, its time to considering spending less on the car (downgrading trim packages possibly) or waiting until you have more saved.

Several reasons are cited for the increase in car prices: above all, the lingering issues with global supply chains including the global supply of processor chips whose manufacturing has been impacted by COVID-19. Even the lowly oil filter is in short supply right now as manufacturers are struggling to find workers and supplies.

Then there is the demand side of the equation. Due to limited travel (no international vacations and less people are flying), lower commuting and work costs (less car, gas, and work clothes), and less events to go to (movies and performing arts are still down 80% – 90% from pre-COVID levels), consumers [CK1] have been saving more money. Combine that with federally provided stimulus checks and it has created a glut of excess discretionary income looking for a home.

With demand high and supply constrained, auto makers have responded by raising prices to increase their profit on lower volumes. It has worked. Manufacturers have posted record profits in the first two quarters of 2021 despite production issues and increasing raw material costs.

The lack of new cars along with the high prices has dragged the used car market up with YOY prices increasing over 30%. The good news is that dealers are offering record amounts for used cars, whether trade-ins or stand alone. I can personally attest. We unloaded my wife’s 2011 Honda CR-V with 89,000 miles and a bunch of kid-related wear-and-tear to a dealer for what I thought was a crazy price. (And it was so much easier than dealing with private showings to boot!)

Based on current conditions, the best move is to hold the cars you have unless you have an extra car. In that case, sell it now. There has never been a better time to unload a car with some minor damage to dealer who would have raked you over the coals for the damage if used as a trade in before.

This is basic economics. Supply & Demand, Econ 101. It’s so simple a caveman could do it. Sell your extra cars and don’t buy a new car unless you must, duh. Right?

But while this has been happening, the federal government and the states have been pursuing their own goals. One of these is the continued push towards cleaner air and renewable energy.

EV Tax Credits

The federal tax credit is most well-known. It allows for a $7,500 tax credit for purchasing an electric vehicle. Unlike many credits, this is not phased out at higher income levels (thus why so many high earners originally favored Teslas). The credit is, however, phased out when the manufacturer reaches a total sales of 200,000 electric vehicles (there is also a similar credit for electric motorcycles). So far, only Tesla and GM have reached the 200,000 EVs sold. The phase-out affects all their models and sub-brands—for example, for GM it includes Chevy Volt and the Cadillac EVs. There is a brief federal phase-out period once the 200,000 is reached. You can see which cars are eligible for which credits here.

At the state level, New Jersey enacted in January 2004 a statute N.J.S.A. 54:32B-8.55 exempting zero-emission vehicles from sales tax. In New Jersey, the sales tax rate on new cars is 6.625% so the amount can be significant: on the average new car value of $40,206, this equates to a savings of $2,334.

On January 17, 2020, Governor Phil Murphy signed S-2252 into law (P.L.2019, c.362), creating the Charge Up New Jersey incentive. The incentive for an eligible vehicle is $25 per mile of EPA-rated all-electric range, up to $5,000 for vehicles with a MSRP under $45,000, or up to $2,000 for vehicles with a MSRP between $45,000 and $55,000. Vehicles with an electric range of over 200 miles are eligible for an incentive of up to $5,000, depending on vehicle MSRP.

The Model Showdown

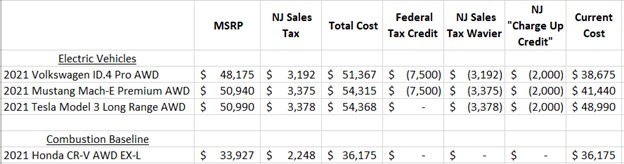

This sounds great, but what is the actual cost of an EV? Crazy high right? Well, I decided to look at the MSRP for three electric cars a family in the Northeast would likely consider (plus as a baseline a similarly trimmed combustion Honda CR-V). They all have heated seats and All-Wheel Drive since most people up here have these as must haves on their car shopping lists.

2021 Volkswagen ID.4 Pro AWD $48,175 – This is a small SUV/hatch back, very similar and a direct competitor to the CRV.

2021 Mustang Mach-E Premium AWD $50,940 – Ford’s advertising is linking the EVs under the Mustang brand with “Mach-E vs Gravity”–type ads to put the model head-to-head against the performance-minded Tesla consumers, but at the Mach-E’s core, it is still a small SUV/hatch back. It just happens to have the same crazy instant torque that all EVs provide.

2021 Tesla Model 3 Long Range AWD $50,990 – How could a Tesla not be in the comparison? This is the smallest of the three but still is a hatchback as all their models really are. The long-range model needed to be selected to get AWD, so the combination of it being smaller and “long-range” give it by far the longest range of any of these choices. Even if it wasn’t long-range, Tesla is by far the battery and range leader of EVs so they would win if that is your main criterion.

Before all the Tesla fans come after me: I understand the Model Y would have been a more head-to-head comparison with the CRV but the price for a comparable model would have increased to $55,990. I wanted to keep Tesla in the running if possible.

2021 Honda CR-V AWD EX-L (combustion, non-EV engine) $33,927 – the baseline comparison model.

All those MSRPs are significantly above the $40K average new car cost, and way above the $34K non-electric CR-V), so you can see why consumers are reluctant to make the switch to EV. Paying an additional 25%–40% is quite a premium to be greener. Americans tend to be most green when it’s convenient and cheap.

But now let’s factor in those tax credits and see how the numbers change:

With the tax credits are factored in, the VW ID.4 is only 7% more than the baseline CR-V. The Mustang Mach-E is 15% more and the Tesla is 35% more. Teslas are hurt by the loss of the federal tax credit, coming in at 35% higher after the credits.

There is currently a proposal in the house for an increase to the tax credit, from $7,500 to $12,500 but the increase is only for USA assembled cars at Union organized plants. Currently, the only model can be classified as both of those is the Chevrolet Bolt EV and EUV. The Ford Mach-E is union made in Mexico and the ID4 is union made but in Germany. All Teslas are made in the USA but none of their plants are union. So, the proposed increase is only going to be applicable if you are looking at the Bolt, it could tax several years for another model to come online that qualifies.

And in addition to the tax credits above, New Jersey also offers a 10% E-ZPass toll discount, and the operating costs of EVs are generally lower than for gas-powered vehicle (up to 50% less according to one study by University of Michigan’s Transportation Research Institute ). These additional savings, and the time savings of never going to a gas station, will easily justify the 7%–15% cost increase.

Should I Buy an EV Now?

Electric Vehicles and the batteries that underpin them are new technology which is improving every year. Range is increasing with every model, and the costs to produce the cars is sure to fall. Combine that with the crazy state of the car market and it seems prices must fall.

Or do they?

Two things are working against new car prices falling anytime soon. First, industry experts are forecasting that the supply shortages will continue through the end of 2022. As the shortages are resolved, the used car market will first see relief and then maybe eventually the new market will. Which brings us to the second point: car producers have always been amazingly stubborn in resisting reducing prices.

Even during the Great Recession when demand fell off a cliff, car manufactures only dropped their prices 2.6% between 2007 and 2009. That’s 2.6% over two years, an average of just 1.3% per year during the largest recession of most of our lives. In 2010, when the unemployment rate was still 9.6%, auto prices increased 6.6%. The industry does a good job of increasing model features, pushing higher trim packages, and reducing the stock of anything that even approaches a base model.

But that is the general auto market. What about the technology and cost improvements for EVs?

Being an economist by training and at heart, I agree with and believe in efficiencies of scale and production improvements. Both will lower production costs for producers. Whether they pass those savings along to the consumer is a different matter, however. A more likely scenario is the first manufacture to realize increased profits will allocate that additional profit to advertising and efforts to steal market share from competitors.

And then there is, of course, the issue of time. You’re also fighting time.

Tick Tock

Tesla and GM have reached the 200,000 in EV sales, excluding them from the federal tax credit of $7,500, but each month more EVs are sold. Nissan is forecast to be the next manufacture to cross the 200K sales threshold, followed by Ford in 2022. The federal credit is by far the largest credit, and if it is lost for the model you want to purchase, it can greatly change the total.

Despite all the production supply shortages, forecasting sales is the easy part. Harder is gauging Congressional support for tax credits. Coastal Democrats would like to expand the federal tax credit on EV adoption and remove the 200K sales cap, whereas most Republicans feel that (a) it is an unneeded credit because adoption is healthy enough due to the lower operating costs and (b) it’s a credit that only benefits upper income taxpayers. The Republicans are probably going to win on this last point, as studies have shown 78% of the credits were claimed by people making at least $100,000 per year and 7% were claimed by people making over $1 million a year.

Remember that proposed increase mentioned earlier to increase the credit for USA Union made cars? It also includes a cap for individuals who make over $400,000 per year ($600,000 for head of household, and $800,00 for joint filers) as well as a cap on the MSRP for cars of $55,000. Those are high caps, but this is just the opening volley in the proposal, I expect the income levels to be lower in the final bill if it is approved.

Limiting support on both sides of the aisle is the fact most union automotive jobs in the US are in factories producing combustion engines. The Ford Mach-E is produced in Mexico, and although Teslas are US produced, their workers are not unionized.

The most likely scenario is that Congress will remove production caps (to help GM and the only USA-made EVs from Tesla) but will add a Union “enhancement” and an income phaseout, as with most tax credits already on the books. For most of the readers here, that will probably lower or eliminate your credit.

Conclusion

So, what to do? As with most things finance, the right answer is if you don’t need it, don’t buy it.

But if you need a car and are considering an electric car (produced by a company other than GM or Tesla), now might be a good time to buy. This is especially true if you are in a high-income tax bracket and could be impacted by a federal phaseout of the tax credit. And if you are in the market for my dream car, the Porsche Taycan EV, you should be running out to buy it now! (I’m assuming you have the income to support that of course)

A decision tree for consideration might look like:

| Income (Single/MFJ) | Should you buy? |

| <$75K/$150K | Wait until after bill |

| <$200K/$400K | Consider waiting until after bill |

| >=$200K/$400K | Consider buying now, you may lose some of the credits |

If you have any thoughts or opinions about this, please drop me an email. This may end up being a real-life decision for me.

Until next time, spend less than you make, invest the difference in low-cost index funds, be kind to your neighbors, and you will succeed in reaching your financial goals and in making the world around you a happier place.

If you feel you could use some assistance along the way, please reach out to us.

These are great points, there are certainly considerations other than just the cost that need to be addressed before converting to an EV. Thanks for the input!

This was a terrific discussion to help us (you?) understand the financial practicality of buying an electric vehicle now. Two additional questions people need to consider for an EV purchase are 1) How do I use my vehicle? 2) How easy will it be for me to charge my EV?

For people with long commutes, or who regularly need to drive a long distance to visit friends or family, they need to consider the effort (not cost) to “fill up”. They need to find charging stations in route and must plan the time needed to recharge their vehicle (plus the ways to entertain the kids during that time). In addition, EV owners cannot assume they can recharge at their destination (e.g., a family member’s home) if that home cannot support recharging an EV.

Gary, Will do, thank you for the kind comments.

This was a very well written article. It was clear, informative, and easy to read. I also like the additional comments that are thrown in. Give my best to Bill who I met some 8 years ago at the Princeton Library in the networking group for those seeking employment.