News Flash: New Tax Deadline; Estimated Payments Still Due April 15

The IRS has pushed back the tax return and payment filing deadline from April 15 to May 17, 2021. While no additional penalties and interest will accrue during that period, estimated payments for 2021 taxes are still due on April 15 as well as most states are keeping the original deadline. If you think you need make estimated payments for 2021, you will still need to have a pretty good handle on your taxes by April 15.

The American Rescue Plan—An Overview

On March 11, President Biden signed into law the most recent stimulus bill, the American Rescue Plan of 2021. This is the third major economic stimulus due to the Covid pandemic in the past 12 months. At 628 pages it is about a tenth of the length of the last bill, but it is still packed with tax implications for individual taxpayers.

The bill includes, among other things:

- Direct payments of up to $1,400 per taxpayer and dependents as prepayments of refundable tax credits.

- Major changes for taxpayers with children or dependents

- Changes to the child tax credit

- Increases the amount per child, with an additional amount for children under the age of 6

- Increases the age by one year for 2021 (from 16 to 17)

- Prepays a portion of the credit

- Dependent care expense deduction changes

- Increases the total amount of expenses allowed

- Increases the Applicable Percentage

- Changes to the child tax credit

- Unemployment compensation changes

- Continues many Federal unemployment programs implemented during the COVID pandemic.

- Allows a possible reprieve from taxation on the first $10,200 per person of unemployment insurance.

- Health insurance changes

- Provides greatly expanded health care policy options for workers terminated in 2021 at zero premium costs.

- Increases the subsidies for those at every income level who receive their health insurance policies from a state-run healthcare exchange (aka Obamacare).

- Discharged student loan debt will continue to not be counted as income through 2025.

- Earned Income Tax Credit (EITC) age for qualification will be lowered to age 19 from 25 for 2021.

As with all tax policy, there are thresholds and qualifications for each of these items. These rules are explained in greater detail in this post.

Direct Stimulus Payments (Advanced Tax Credits)

As with all three stimulus bills, the major headline is the direct payments to taxpayers based on their reported Adjusted Gross Income (AGI). The payment, technically a prepaid tax credit, has increased from $600 in the last bill to $1,400 per dependent, and the definition of dependent is more liberal.

In the last bill, the Consolidated Appropriations Act (CAA), a dependent was defined as anyone under the age of 17 who met the normal qualification guidance. The American Rescue Plan expands this to include both full-time college students and parents who qualify as dependents. This provision is a win for taxpayers providing support to anyone in these groups.

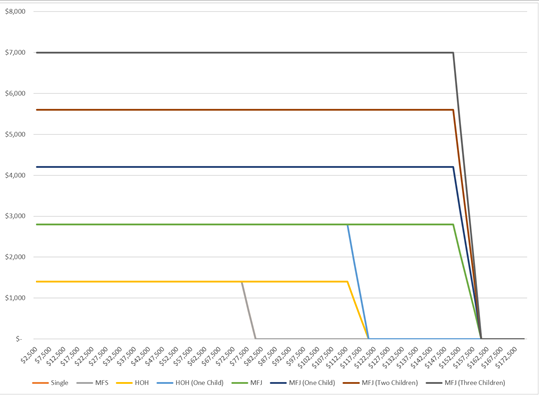

The bad news is the bill changed the AGI thresholds, making it harder to qualify for the tax credit with threshold amounts that are nearly a cliff regardless of the number of dependents. In the CAA, although the phaseout number was the same ($150K), the credit was phased out at $5 per $100 of AGI. So if the starting amount of the credit was higher (i.e., more dependents), it took more income to totally phase out the credit. Below is a great visual representation of the CAA phaseouts from Michael Kitces:

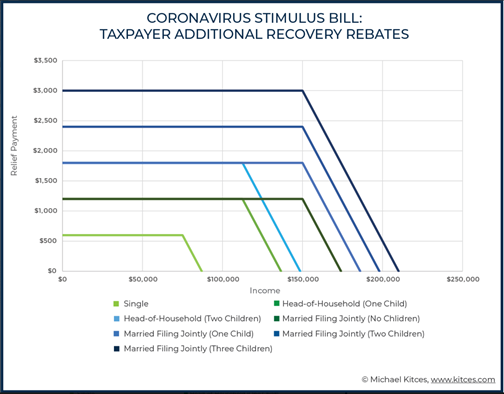

Now compare that to the new bill’s phase-out amounts:

- Single Filers and Married Filing Separate: $75,000 – $80,000

- Head of Household: $112,500 – $120,000

- Married Filing Joint: $150,000 – $160,000

Or visually:

The big takeaway is that the top end of phase-out range does not change based on dependents. Put another way, the more dependents you have, the more marginal rate of tax you incur for each dollar of income over the phase-out range. Based on the number dependents, the marginal tax rate through this range could be greater than 200%!

If you are close to that range with two income earners (for example, one spouse earns ~$60K and the other ~$90K), there could be an advantage to filing as married filing separately. If you think you may be in this phase-out range, we recommend working with WJL to make sure your taxes are run under both scenarios.

The calculation will be reviewed three different times, with each review being referred to as a “checkpoint.” The first checkpoint is based on either your 2019 tax filing or your 2020 return if you have already filed. The second checkpoint will be the Additional Payment Determination Date, which is either:

- 90 days after the 2020 calendar year filing deadline, or

- September 1, 2021

The reason for this second date was to create a drop dead date in case the IRS extended the filing deadline, which it has, as mentioned in the opening.

The third checkpoint will be when you file your 2021 tax return.

Assuming you qualify for the credit at any of those three checkpoints, you will receive it, and, just like the other stimulus payments, it will not be clawed back if your income increases later.

Child Tax Credit

A major social goal of this act was to battle child poverty, but the act has implications for parents across the income spectrum.

For the 2021 tax year, the Child Tax Credit has been “enhanced” from $2,000 to $3,000 per qualifying child. A further enhancement increases the tax credit to $3,600 credit for children under the age of 6 as of December 31, 2021. The bill also created a separate phase-out of the enhancement above the normal child tax credit of $2,000 as follows:

- Joint Filers: $150,000

- Head of Household: $112,500

- All other filers: $75,000

If your AGI is above those amounts, the enhanced amounts are phased out at $50 per $1,000 of AGI above the threshold. Again, these phase outs are separate from the phase out for the normal $2,000 child tax credit.

The phase out for the normal $2,000 per child Child Tax Credit continues to be $50 for every $1,000 a taxpayer is over an AGI of $400,000 for Joint Filers and $200,000 for single filers. With the different phase-out amounts, it is possible to be completely phased out of the enhanced amounts and still receive the full normal Child Tax Credit.

If you have a child who is 17 years old at the end of 2021, there is a nice little pick up included in the bill for you too. For 2021 only, the age for a child to qualify for the Child Tax Credit has been increased from 16 (technically “under the age of 17”) to 17 (technically “under the age of 18”).

The American Rescue Plan also builds on the Tax Cuts and Jobs Act of 2017. The prior act made up to $1,400 of the Child Tax Credit a refundable tax credit. Now the entire Child Tax Credit, including any applicable enhanced amount, is fully refundable.

The American Rescue plan also creates an advance payment for 50% of the estimated Child Tax Credit amount for 2021 in equal installments from July 1, 2021, through December 31, 2021. For example, if you have three children aged 7, 9, and 11 and qualify for the full enhanced amount of $3,000 per child, you will receive $500 per month between July and December 2021 (50% × [$3,000 x 3] / 6 = $750 per month). This sounds a lot like an additional stimulus payment, but there is a catch. If your income increases in 2021 and you are phased out of some or all of the credit, the excess amount will be clawed back when your 2021 return is filed.

But—and there is always a but—the IRS has allowed up to $2,000 of overpayment per child to qualify as a safe harbor amount if your AGI qualifies. The phase-out ranges for that safe harbor are below:

Joint filer: $60,000 – $120,000

Head of Household: $50,000 – $100,000

All Others: $40,000 – $80,000

The prepayment and the clawback calculations are only for 2021.

But wait, there’s more!

The American Rescue Plan also increases for 2021 the amount of dependent care expenses that can qualify for the Child and Dependent Care Tax Credit. Previously this amount was calculated using a maximum of $3,000 of expenses when the taxpayer had one qualifying child (under the age of 13 for the entire year) and $6,000 of expenses when the taxpayer had two or more qualifying children. With the American Rescue Plan, the amount has increased to $8,000 for one qualifying child and to $16,000 for two or more.

The amount paid for dependent care expenses is then multiplied by a percentage called the “Applicable Percentage” to come up with an amount that can be deducted. The Applicable Percentage starts at 35% but is quickly reduced by 1% for every $2,000 above the AGI floor of $15,000 (for all filing statuses). The effect is that an AGI of $45,000 the Applicable percentage has reached the lowest possible floor of 20%.

Under the American Rescue Plan, the Applicable Percentage begins at 50% and does not begin to phase out until AGI reaches $125,000 (for all filing statuses). Above $125,000 AGI, the phase out uses the same calculation as before, with a 1% reduction for every $2,000 above the threshold. So now the 20% Applicable Percentage floor is not reached until an AGI of $185,000.

This dramatic increase in both the amount that can qualify for the credit and the Applicable Percentage can increase the amount of the credit by almost 400% if the taxpayer has the full amount of the expenses and is not phased out of the Applicable Percentage.

But wait, there’s more!

Those who qualify for the max Applicable Percentages would normally not have the taxable income, and therefore tax burden to take full advantage of the tax deduction, so the American Rescue Plan went one step further and made the normally nonrefundable credit refundable. This ensures that even low-income taxpayers will receive the full benefit. The largest beneficiary will most likely be single-parent households that incur significant dependent care costs so the parent can work.

To help pay for these additional benefits, it is now harder for high-income families to realize the dependent care credit, specifically families with AGIs over $400,000. Prior to the American Rescue Plan, the lowest the Applicable Percentage could be reduced was to 20%, regardless of AGI. Under the new plan for 2021, for every $2,000 AGI exceeding $400,000, the Applicable Percentage is reduced by 1%. At an AGI of $440,000, the Applicable Percentage is reduced to zero, and the taxpayer receives no credit.

Unemployment Compensation

The American Rescue Plan extends several Federal support programs for unemployment compensation through September 6, 2021. These include Federal subsidies to states providing unemployment compensation for long- term unemployed workers, pandemic Unemployment Assistance for workers (such as self-employed workers) previously not covered by unemployment insurance, the Federal Pandemic Unemployment Compensation (FPUC) program that increases the state’s weekly unemployment compensation amount by $300 and extends the Federal reimbursement for the first week of state unemployment coverage to reduce the elimination period normally required by the states.

A new twist was added to unemployment compensation, which is normally taxed at the Federal level. The American Rescue Plan added a provision such that if the taxpayer’s AGI is below $150,000, regardless of filing status, then the first $10,200 per person of unemployment compensation can be excluded from taxation. The $150,000 is a cliff, so at $1 over the complete exclusion is eliminated.

Although the IRS is still issuing guidance on this provision, it seems the provision is written so that the unemployment compensation is included in the AGI used for the calculation. Therefore if you have normal income of $145,000 and unemployment of $10,000, the entire unemployment compensation is taxed because the AGI for the calculation is $155,000. It’s also unclear if married filing jointly (MFJ) taxpayers would be better off filing as married filing separately (MFS) if each taxpayer is making roughly the same amount and is close to the $150,000 threshold in total—for example, if each have compensation of $75,000 and each unemployment of $10,000. As MFJ they would be over the AGI cliff since the threshold is regardless of filing status; they would be under it if filing MFS.

Health Insurance

The American Rescue Plan has made health insurance for more affordable for workers who lose their jobs.

First it creates new subsidies for workers terminated in 2021 so they can maintain health insurance coverage through COBRA. COBRA gives workers and their families who lose health benefits from their former employer the right to continue coverage from their previous employer for between 18 and 36 months (depending on reason for loss of coverage) at an unsubsidized cost of up to 102% of the cost to the employer. In most cases, this is cost prohibitive and the worker is forced to drop coverage due to costs.

With the new law the government picks up 100% of the cost of COBRA coverage between April and September of 2021 by directly reimbursing the employer through a refundable payroll tax credit.

The other option for terminated workers who do not qualify for Medicare or Medicaid is to buy a policy from a state-run health insurance exchange (commonly called Obamacare). These policies are sold directly to the policyholder, who is provided Premium Assistance Tax Credit (PATC) to mitigate the cost based on income (AGI). For 2021 and 2022, the bill lowers the maximum amount of income a taxpayer is required to spend on a policy. The bill provides assistance at both ends of the income spectrum. At the low end, incomes of up to 150% of the poverty line will now have their premiums completely covered by the PATC. At the high end, regardless of income the most the policy can cost the taxpayer who does not received PATC is 8.5% of income (there was no cap for incomes over 400% previously).

Also impacting PATC was the elimination of the clawback calculation for 2020. In 2019, and again in 2021, if you received a PATC based on your prior year income but had higher income in the current year, the IRS recovered the excess credit amount when your tax return was filed. For 2020 only, this clawback feature has been suspended.

But wait, there’s more! (Yes, yes, I know I’m over doing the Billy Mays infomercial tagline, but this is a lot of boring tax stuff I’m going through here.)

For 2021, if a taxpayer is terminated in 2021 and receives at least one week of unemployment compensation they are automatically considered to be treated as if their income did not exceed 133% of the federal poverty line for calculation of PATC. Recall from earlier, this would mean that their premium is completely covered by PATC for a state exchange purchased policy. There are no upper income thresholds for this rule.

There could be a scenario where an employee is terminated in April, gets their previous employer to pick up the cost of their old plan through COBRA until September (which I will assume in this example is better than the state exchange choices, though it may not be), and then gets a state exchange plan for no cost! Sounds close to universal healthcare, but only if you’re terminated in 2021, and this only covers 2021. A termination can be a significant and emotional event for a family and hopefully these changes will help with the job transition for many impacted people. Having healthcare taken care of will certainly be appreciated.

Student Loans

The only meaningful change to student loans was extending the provision whereas discharged student debt is not taxed as income through 2025. Many younger workers carrying large student loan balances were hoping for more, and Biden has indicated intentions to address this.

Earned Income Tax Credit

One last item impacting individual taxpayers is the reduction in age for the childless Earned Income Tax Credit (EITC). Previously this was only available to low income earners under the age of 25 but that is lowered, for 2021, to 19 and the amount of the credit almost triples. Below is a chart the Urban Institute prepared to show the EITC levels and phase outs. If you think you qualify and want more detail, you can contact WJL to review your taxes or you can read the Urban Institute’s extended article about the credit here.

Final Note

It’s interesting to note what was taken out of the House proposal the Senate passed because often the bits removed show up later in other bills. One section removed was a proposed elimination of the inflation adjustment for retirement saving vehicles such as 401Ks, IRAs, etc. As an example, the inflation adjustment is the reason the deductible amount for a 401K goes from $19,000 in one year to $19,500 in the next year. It ensures that your savings keep up with the silent wealth destroyer called inflation. Removal of the inflation adjustment would have been equivalent to a stealth tax increase since less and less income each year could have been deferred and saved for retirement tax free. Watch out for this sneaky little clause to appear in a later bill.

Closing

How much would you pay for all this awesomeness? Two low payments of $19.99?!?!? According to the Taxfoundation.org, this bill is going to cost you $1.9 Trillion.

Until next time, spend less than you make, invest the difference in low-cost index funds, be kind to your neighbors, and you will succeed in reaching your financial goals and in making the world around you a happier place.

If you feel you could use some assistance along the way, please feel free to reach out to us.