Tap into our expertise. Once a month we publish a blog on various financial planning topics.

KEY TAKEAWAYS:

- Healthcare from the ACA exchange can be an affordable option for Early Retirees or people going through a job transition, especially compared to COBRA or private policies.

- The American Rescue Plan Act of 2021 extended subsidy levels to reach higher income levels than ever before.

- The deadlines for applying for coverage is as early as December 15th for the federal exchange so get moving! The deadline in your state may be later if they have their own exchange.

Tired of reading already? We’ve got you covered! Watch our YouTube highlight video:

Intro

In our financial planning practice, we spend a fair amount of time helping people who are in a job transition or retiring early (before Medicare coverage begins). In those discussions, many people are planning to pay for health insurance through COBRA or don’t think they can retire early due to healthcare costs fears. What they don’t realize is they can get quality coverage and save hundreds of dollars a month on premiums due to the subsidies available when purchasing their health insurance from the government’s health care exchange. The American Rescue Plan Act of 2021 has expanded the subsidies to even more income levels. This blog provides an overview of the government health care exchange for anyone looking for affordable healthcare options.

Gaining Subsidies for Health Coverage: A Quick Overview

Even if COBRA is available, you can purchase a plan on the Affordable Care Act (ACA, also known as “Obamacare”) exchange and potentially qualify for a subsidy. In addition, if you live in a state that has expanded Medicaid coverage, you might qualify for fully subsidized health care if your annual income is low enough.

The way the health care exchanges work is that private insurers provide the insurance for individuals and families either not covered under a group plan from an employer or covered by an employer plan designated as not affordable. But its more than just a marketplace as, based on income, the government may step in subsidize the cost.

ACA plans are grouped in tiers based on the percentage of cost paid by the patient through deductibles, co-pays, coinsurance, etc. Bronze plans have the highest deductibles, co-pays, etc. and thus the lowest premiums. Gold plans have the lowest deductibles, co-pays, etc. and thus the highest premiums. Silver is the tier in the middle.

Subsidies for Insurance Premiums

Individuals and families with modified adjusted gross incomes (MAGI) below certain thresholds qualify for subsidies from the federal government. The government directly pays the insurers, thus lowering your premium. MAGI is adjusted gross income from your tax return (income before deductions and exemptions)—adjusted up for items such as tax-exempt income, income that dependents earn, etc. that are typically not part of adjusted gross income (AGI).

The premium subsidies are tax credits you receive in advance. You estimate your modified adjusted gross income for the upcoming year, which then determines the subsidy. When you complete your tax return at the end of the year, the subsidy is recalculated based on your actual MAGI, and you’ll either pay back some of the subsidy or receive an additional amount, depending on whether your actual MAGI was above or below your estimate.

Prior to the American Rescue Plan Act of 2021, premium subsidies kicked in when MAGI dropped below 400% of the poverty level (based on family size). The American Rescue Plan Act extended eligibility for ACA health insurance subsidies to purchasers with incomes over 400% of the poverty level. Previously there was an income “cliff.” If your adjusted gross income was one dollar over the threshold you lost the entire subsidy. Now the subsidy slowly phases out based on the cost of the benchmark plan as a percentage of your income until your income is large enough that the cost of insurance is less than 8.5% of your MAGI.

This extends the subsidies to a far greater number of people. The cost of the benchmark plan depends on the ages of the participants since premiums on ACA plans increase with age. Older participants with more expensive plans will have higher income thresholds and larger subsidies. The law also increases the amount of financial assistance for people at lower incomes who were already eligible under the ACA. Both provisions are temporary, with the changes sunsetting in 2023. However, the Build Back Better plan currently being debated in Congress would extend these changes to 2025.

For 2021 coverage, under the modified rules implemented by the American Rescue Plan, subsidy-eligible enrollees who buy a benchmark plan in the exchange will be responsible for up to the following percentage of their MAGIs for their coverage. The difference is the subsidy amount:

- Income up to 150% of poverty = 0% (the subsidy will make the cost of the benchmark plan1 premium-free)

- 150% to 200% of poverty = 0% to 2%

- 200% to 250% of poverty = 2% to 4%

- 250% to 300% of poverty = 4% to 6%

- 300% to 400% of poverty = 6% to 8.5%

- 400% of poverty or higher = 8.5%

As an example, the average cost of an unsubsidized silver plan for a family of four on the federal healthcare exchange in Texas is $1,635/month ($19,620/year). If your annual income is $230,824 or greater, the plan will essentially remain unsubsidized because 8.5% of $230,824 is $19,620.04 making it below your threshold amount. But let’s now assume you’re an early retiree or someone with missing months of income and your income is now going to only be $110,000 (this number was chosen because it also 400%+ above the poverty level). At that income, the max you will be responsible for is $9,350 or $779/month. Your subsidiary would therefore be $856/month!

Cost-Sharing Reductions

While premium subsidies help pay insurance costs, lesser-known cost-sharing reductions (CSRs) are available that reduce the out-of-pocket exposure for eligible enrollees. These subsidies kick in when income drops below 250% of the poverty level. Unlike cost-sharing subsidies, CSRs are available only on silver plans.

Depending on your income, you will end up with lower deductibles, co-pays, etc. with no additional premium. Unlike the premium subsidy, there is no reconciliation at the end of the year for the cost-sharing subsidy if it turns out your income was higher or lower than your initial projection. For example, the deductible for a couple over the cost-sharing threshold is $4,500. If income drops below the first threshold, the deductible would drop to $3,600, to $1,400 if income drops below the second threshold, and to $800 if income drops below the third threshold.

Medicaid

If your income is below 138% of the poverty level, you will not qualify for an exchange subsidy. Instead you will be referred to the state Medicaid program, assuming you live in a state that opted to expand Medicaid. (The Supreme Court ruled that states were not required to expand Medicaid, and many did not.)

Income Thresholds

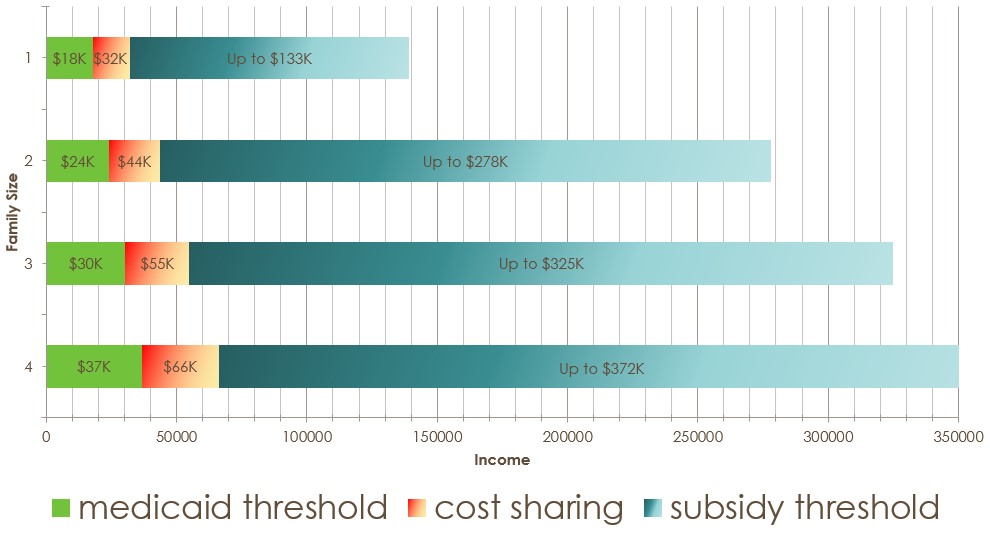

The chart below shows the income thresholds in 2022 for the two subsidies and Medicaid, based on family size for 2022 coverage:

Note: The Medicaid threshold is considerably higher for dependents 18 years old and younger, so it is possible that the parents qualify for an exchange plan while the children qualify for Medicaid.

Given that COBRA is not subsidized, if you qualify for a subsidy on the exchange, it is likely that a plan obtained on the exchange will be far less expensive than COBRA.

Estimating 2022 Income

For those in transition, estimating and documenting your 2022 income can be problematic since you do not know when you will land a new job. Be sure to think through the implications of the estimate you provide. Some people we have spoken to do not want to end up on Medicaid because they see doctors who do not accept Medicaid patients. In that case, you may need to employ strategies (such as Roth IRA conversions) to boost your income over the Medicaid threshold. This is especially true for early retirees who may not have any reportable income without performing a conversion.

You will be able to go into the exchange later and adjust your estimated income for the year, up or down, if your situation changes, including getting a new job. You may have to pay back some or all of the subsidy if the income from your new job causes your annual income to exceed your initial estimate. I would not worry too much about this. If you land a job early in the year, your income will likely end up over the threshold and you will have to pay back the entire subsidy. But that would only be a month or two of subsidy since your ACA coverage would stop when you gain access to employer coverage. If you land a job late in the year, the annual income should not increase much relative to the initial estimate since you only have a few months of earnings. Landing a job in the middle of the year might be the most problematic if it puts your income level just over the threshold, but there may be ways, such as pretax 401K contributions, to keep your income below the threshold.

Be aware that taking distributions from pretax retirement accounts will increase your income and therefore decrease the amount the subsidy (increasing the marginal tax rate on that income). You may want to consider other options, if available, for current cash flow needs.

Deciding between COBRA and the Exchange

Before switching plans you’ll want to ensure that you consider all costs and not just the change in the premium (assuming you don’t qualify for a cost-sharing subsidy). The plans available to you on the exchange may have different deductibles, out-of-pocket maximums, coinsurance percentages, etc. when compared to your COBRA plan. Any comparison you do should include all these factors.

In our last blog post, Two Things You MUST Do for Your Finances Before Year-End, we walked through a process for comparing healthcare plans. At a high-level it involves:

- Reviewing whether your doctors are in-network (or considering whether you are willing to switch).

- Looking at your prior year spending by reviewing the information on your prior year’s health plan provider website, which usually offers a way to run a report for all this information.

- Combine the information from #2 with the plan proposed plan details. Each plan on the exchange may have different deductibles, out-of-pocket maximums, and coinsurance percentages. The best site I have found to compare health insurance plans costs is https://health-plan-compare.com/” https://health-plan-compare.com/ (we are not affiliated with this site in any way). If you decide to give it a shot, make sure you see the note that the server will clear your entries if you let the input information sit for a while. It’s super frustrating to lose your work, so be aware.

Deadlines for Enrolling

The deadlines for open enrollment for 2022 depend on whether your state has its own exchange or uses the federal exchange. The federal exchange has a deadline of January 15th for any coverage in 2022 and December 15th for coverage beginning January 1. Here in New Jersey, we have a state-run exchange which is a little more generous, with 15 extra days for each deadline. The deadline for any coverage is January 31, and if you enroll by December 31 coverage will begin January 1. For both exchanges, if you miss the first deadline, coverage will start February 1.

If you miss this open enrollment period, you will have to wait until 2023 to enroll unless you qualify for a special enrollment period. You can only switch from COBRA to an exchange plan outside of open enrollment is if the eighteen months of COBRA coverage expires or if your former company pays your COBRA premiums for a period of time and then stops.

If you already have an exchange plan and want to keep the plan you have, you can do nothing, and it will automatically renew.

The Healthcare Exchange Can Provide Affordable Health Coverage

Despite negative press about the state-run and federal healthcare exchanges, they are a great way for people without employer-provided programs to get affordable healthcare coverage. And the biggest benefiters are people going through job transitions or retiring before they are eligible for Medicare.

Until next time, spend less than you make, invest the difference in low-cost index funds, be kind to your neighbors, and you will succeed in reaching your financial goals and in making the world around you a happier place.

If you feel you could use some assistance along the way, please reach out to us or leave us a comment below.

Note 1: Benchmark plan definition: On the federal exchange, the benchmark plan is the second-lowest-cost silver plan in the exchange in each area, in the individual/family insurance market. State exchanges may have different definitions.